Sweden has no legal requirements for minimum wage, but in practice there are workers alliances and the like that quote specific wanted rates, and workplaces can't claim to follow those standards (thus rendering themselves undesirable as employers) unless they pay those rates.

For example the minimum wage for an adult restaurant worker with no previous work experience, according to the hotel and restaurant alliance, is approx $14.9 an hour. This rate includes waitstaff because in this country people aren't expected to live off tips alone. The waitstaff's full wage is taken into account in the pricing of the dishes.

In Missouri it's the lowest allowed: $7.25.

Edit: but the wait staff minimum wage is probably lower. In the early 2000s when I was a waitress, I made $3.25/per hour. I had to get tips in order to make anything (I was in High School...so I didn't need the money yet, but some of the staff were like my mom's age o_O)

15.00$ an hour

That'e the lowest you are legally allowed to pay someone an hour here if they are over 18.

This year though they introduced some weird law where if you are under 18 and still in school, min wage is 13.00$ an hour. This does NOT apply to youth that are NOT in school. If they are not in school they get paid the full 15.00$ an hour.

In Denmark we don't have a law about what the lowest wage has to be, but several work-unions have come up with general rules for what is acceptable and they enforce them through trials/lawsuits (so even if the government hasn't put down a law it's still a legal practice) and we are currently at an average minimum wage of 110kr /an hour (roughly 16,4 dollars /an hour) across all types of work fields.

Of course, this only applies if you are 18+ in age. The moment you are under 18 the minimum hourly wage gets cut in half which is 55kr /an hour (8,2 dollars /an hour).

Also bear in mind that you need to pay taxes before you get your pay; 110kr - 47% = 58,3kr (8,70$ /hr) for those above 18 y.o and then 55kr - 47% = 29,15kr (4,35$ /hr) for those below 18 y.o.

EDIT!

- These numbers are including taxes that differ between 35%-41% depending on the region you live in and on top of this we have an additional 8% that goes to the Labor Market Contribution.

Quick math!

- In my region, the tax is 39% and the LMC (Labor Market Contribution) is still 8%

- That is 39% + 8% = 47% IN TAXES ALONE

- Now if I want to earn 10$ on a commission I have to apply 47% on top of the base price to make up for the loss I have to pay the government as a freelancer (which is, sadly, the 47%). This is 10$ + 47% = 14,7$ total.

In the smaller numbers, it doesn't look all that bad, but it gets aggressively worse the higher up in prices you go.

20$ + 47% = 29,4$

50$ + 47% = 73,5$

100$ + 47% = 147$

200$ + 47% = 294$

I hope this little extra info will help some ppl understand why prices sometimes seem outrageous and unfair, cuz, trust me when I say this... I. HATE. THESE, NUMBERS! but I can nothing about it.

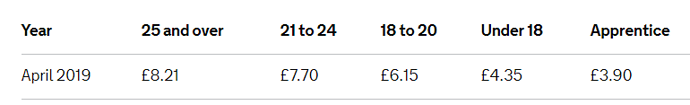

depends on how old you are, which is bollocks

i only acknowledge the real living wage though:

the minimum wage in the uk is utter bollocks, it makes me so mad that youre not entitled to a ''''''''living wage'''''''''' until youre 25. as if rent is just cheaper when youre 24???? i distrust ANY and ALL companies in london that pay any of their workers less than £10.55/hr

A lot of companies just pay the flat minimum wage for admin purposes and it should be noted that "living wage" is the same as when they first started raising the minimum wage a few years ago (it goes up 20-50p every April and October) with the aim of getting everyone to the living wage. Only that living wage target hasn't been adjusted since it was set so probably now falls well below the actual living wage.

That apprentice wage is the thing to note though. There is no age limit of apprenticeships. You can still be 25+ can get the apprentice wage. Although that it little more complicated because they can only pay you the apprentice wage for a year before they have to pay you your real wage, hence why so many apprentices will let you go after a year. Also, worth noting the government pays an apprentice wage, not the company with the aim of getting the company to top up your wages (like that would ever happen).

With the exception of some specific areas, there is no minimum wage in Switzerland, but there are unions and regulations that determine the acceptable minimum pay. Regardless, the minimum hourly wage is around 19 CHF (17,2 EUR; 19,1 USD). In rural areas it can be lower, and in larger cities it's higher, but so will be your cost of living. Sounds like a lot of money, but many fees and taxes that in other countries get taken automatically from your paycheck, here you have to pay them by yourself after you receive the money. A while ago I did the math and with all the stuff I'm obligated to pay, if it was a tax it would be close to 40%.